Most dentists that we work with have grown their practices and incomes over the years, even paying off their debts. Additionally, some have been practicing as independent contractors and want to set up and build their own practices.

But most of them have one thing in common.

They want to save on taxes and save for retirement.

The majority will then choose to set up an entity; either a C corporation, S corporation, or a sole proprietorship. But not all of them are created equal, since some are more advantageous than others.

Others consider taking advantage of Section 179 deduction or R&D deductions. But while these may be great ways to save on taxes and invest in your dental practice, these rules are complex and make it challenging to take advantage of them.

Plus, most people don’t know what taxes will apply and what the tax code will be in the future. Tax laws keep changing, yet we’re trying to help them plan for the next 10, 15, or 20 years.

Indeed, financial planning for dentists and tax planning for dentists involves many moving parts. Therefore, a professional financial planner must know how to put every piece together for maximum efficiency.

Whatever their needs are, dentists and physicians come to us asking for ideas, thoughts, and ways they can save money on taxes and eventually save for retirement. Plus, the method you need to succeed depends on your specific goals.

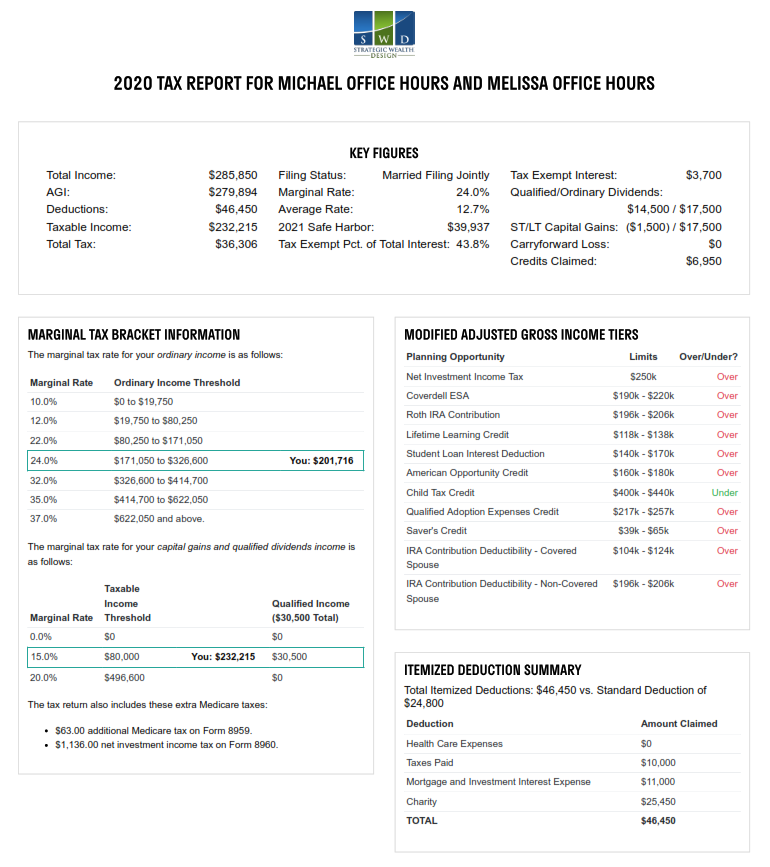

Luckily we use a tool to run a tax report to see where they are and if they’re not taking advantage of all the dental tax deductions.

Also, by understanding the tax laws and taking advantage of available dental tax deductions, you can keep more of your hard-earned money. This blog post will discuss how dental practices can reduce their taxes and improve their bottom line.

Tax saving strategies for dentists

1. Choosing the right entity

Choosing the right business entity can help dentists save on taxes, better prepare for their practice’s ultimate sale, and create more savings for retirement. The business structure can influence everything, from operations to how you protect yourself from creditors.

There are five types of business structures available in the US: Sole Proprietorship, Partnership, S-Corporation, C-Corporation, and Limited Liability Company (LLC). However, LLCs and S-Corporations are the most common for Dentists.

LLCs are great for shielding the Dentist from any business liabilities. In addition, they can provide flexibility on how you want to be taxed as a Sole Proprietor, Partnership, or Corporation.

S-Corporations also shield the Dentist from business liability, avoiding the double taxation issue of C-Corporations, and can provide a cap on Self-Employment taxes. However, they add a bit more complexity and administrative hassles.

When you form a new entity or go through a reorganization, it is crucial to evaluate the pros and cons of all the choices available to you. You’ll need to think about the implications on your liability and the overall management of your business.

Consult with a tax advisor or financial advisor to ensure that you’re taking advantage of all available tax breaks and avoiding potential pitfalls.

2. Section 179 Deduction

A Section 179 deduction is a significant tax break that allows you to deduct the entire cost of qualifying equipment and software you purchase or finance during the year.

It is one of the most important tax codes for small businesses that allow them large deductions for investing in new equipment or technology.

Therefore, dentists looking to purchase new dental equipment for their practice may be interested in the Section 179 tax deduction.

The 179 tax deduction allows you to expense the entire cost of qualifying equipment when you purchased it. The limit for the deduction in 2022 is $1,080,000. However, dentists need to be aware that the spending cap on equipment purchases is $2,700,000, which means the deduction after $2,700,000 is reduced on a dollar-for-dollar basis.

Bonus depreciation is also available for 100% of the cost of qualifying equipment in 2022. Unless Congress renews it, the bonus depreciation will reduce to 80% for purchases you make in 2023 and decrease by 20% for each year until 2027. So, if you are considering purchasing equipment, 2022 may be the year to do it before the current benefits expire on December 31st.

One item to keep in mind is that you must place the equipment into service by December 31st, 2022, to qualify for the tax deduction.

3. Funding a Qualified Retirement Plan

One of the easiest ways to save on taxes while also saving for your future is to fund a retirement plan.

Dentists often have trouble saving enough money for their retirement. I know this because many dentists are either focused on paying off debt or investing in their practice. We always recommend having a balanced approach by diversifying your net worth and taking advantage of the current retirement plan benefits.

There are many different retirement plans, but the best one for dentists is usually a profit-sharing plan with a 401k provision. You can contribute up to $61,000 in 2022, and if you’re over 50 years old, you can fund an additional $6,500.

On the other hand, a defined benefit plan will generally give you a much higher contribution amount. This is also a popular type of retirement plan once your taxable income exceeds $500,000 and you are looking to save aggressively for retirement. However, this plan is generally more rigid than a profit-sharing plan with a 401k provision.

So, if you’re a dentist looking to save for retirement, I’d recommend starting with a profit-sharing plan with a 401k and considering a defined benefit plan as your income grows.

A SEP plan is also an excellent way for a dentist who is set up as an independent contractor to save on taxes. It’s simple to establish and operate, has low administrative costs, and is flexible in annual contributions. Dentists can choose to make more significant contributions in good years and reduce the amount in bad years.

One of the shortfalls of the SEP-IRA is that the employer contribution is 100% vested, and the employer must contribute the same percentage of pay for all eligible employees. So, once you start hiring employees, a SEP-IRA is usually not the best option for a dental practice.

Strategic Wealth Design can help you assess your situation and choose the best retirement plan for your needs. We’ll work with you and your accountant to ensure that everything is structured in the most tax-advantaged way possible.

4. Research and Development Credits

It’s no secret that technology is changing the world of medicine, and dentists are on the cutting edge of this change.

For example, dentists use 3D printers to create everything from aligners to crowns. The 3D technology has eliminated the need for some dentists to send lab work, saving time and money. And, as a bonus, it’s also saving on taxes. So, it’s a win-win.

However, most dentists do not know that their use of technology and building new processes may qualify them for the Research and Development Tax Credit. Even CPAs and Tax Accountants don’t generally specialize in R&D Tax Credits because of their complex nature, thus overlooking this critical tax benefit.

Also, take note that this is a credit and not a deduction. A deduction reduces your taxable income. A credit offsets your tax liability dollar-for-dollar.

To qualify, dentists must prove that their research costs meet four specific criteria;

- The research must be technological such that it relies on hard sciences, such as engineering, computer, or biological sciences.

- It must either create new products or improve existing products or software,

- A process of experimentation to test the product’s validity, and

- Have a qualified purpose and eliminate uncertainty in the business.

So, are you undertaking any research that meets these criteria?

If yes, you may be eligible to save on taxes by expensing eligible costs such as research expenses, employee wages, and costs of supplies.

Although the credit can be significant, it’s important to note that not all research activities will qualify. So, it is essential to find a firm specializing in R&D Tax Credits as the rules can be complicated. In addition, these specialists can guide you through the process and assist with documenting the research so it can withstand an IRS Audit.

5. Employing Family Members

The IRS allows you to hire your children (for legitimate work), and any salary they receive is a tax-deductible expense to the business. This would be similar to hiring any other employee.

However, one of the benefits is that if the child is under 18, they do not have to pay FICA (Social Security and Medicare) taxes. Moreover, children under the age of 21 are not required to pay unemployment taxes.

Additionally, the child will have to pay income taxes on their salary. However, because the standard deduction is so high ($12,950 in 2022), the first $12,950 of income is essentially tax-free.

Lastly, hiring family members will also allow them to participate in the retirement plans offered by the practice.

Please note that your child or family member must be an actual employee with specific job duties, and their compensation must be reasonable.

Employing family members provides various benefits for dentists to reduce taxes. We’ll help you understand these benefits and will work with your tax accountant, so you can save money on your taxes and grow your dental practice.

Get help on your tax strategies & tax planning for dentists.

Dentists have several ways they can reduce their taxes and grow their dental practices. We’ve outlined five tax methods in this blog post, but there may be other tax savings strategies that will work for your specific situation.

Consult with a qualified tax specialist for professional advice to benefit from these strategies. And remember, the earlier you start planning for taxes, the better off you’ll be.

If you’re a dentist, it’s essential to stay up-to-date on the latest tax planning strategies to reduce your taxable income. Our financial advisors are trained to work alongside your accountant to help you develop a plan to minimize your tax liability.

Contact us today to learn more about our tax planning services for dentists. We’d be happy to answer any questions you have!

Cambridge does not offer tax advice.