Are we in a recession?

You might be understandably nervous with so much talk about recession and inflation in the headlines. Recessions can feel like a financial whirlwind, and the S&P 500 having its worst first six months since 1970 doesn’t give us much confidence either.

Recessions cause consumers and businesses to reevaluate their priorities and cause people to panic and have knee-jerk reactions. And by the time you read this article, the US may officially be in a recession.

So, what is a recession?

A recession is a business cycle when there is a decline in overall economic activity. Recessions are generally triggered by a widespread reduction in consumer and business spending. This can be due to financial crisis, loss of consumer and business confidence, high-interest rates, stock market corrections, etc.

How do we know we are in a recession?

The National Bureau of Economic Research (NBER) determines if the US economy is in a recession. The Bureau will provide the start and end dates of the recession, with the general rule of thumb being that we are in a recession when we have two consecutive quarters of negative GDP growth.

The GDP declined in Q1 2022 by -1.6%. When writing this article, the New York Fed’s model showed an 80% chance of a recession, and Atlanta’s Federal Reserve is anticipating negative GDP growth of -1% in Q2 2022.

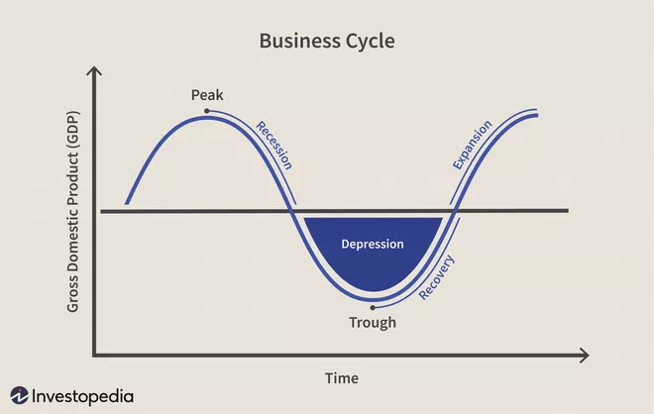

Recessions are inevitable and are perfectly normal. Recessions are just another business cycle phase (see graphic from Investopedia).

However, one of the most complex parts of a recession is the market panics, volatility, and emotional highs and lows. So when you hit one of these low points, please keep these three things in mind.

One: Avoid knee-jerk reactions. Watching the stock market and the value of your investments rollercoaster can test the patience of even the most disciplined investor. But avoiding emotional reactions is critical to protecting your long-term goals.

Two: Revisit your risk tolerance and portfolio. If the recent volatility has you uneasy, reconsider how much risk you’re willing to accept in exchange for potential growth in your portfolio. Likewise, if your risk appetite has decreased because your life’s priorities have changed, you should revisit your strategy.

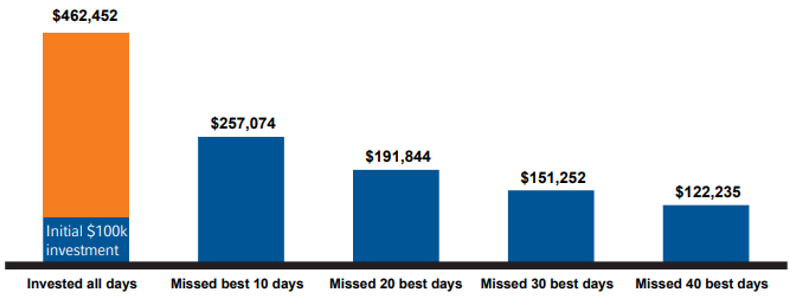

Three: Reach out to your Financial Advisor for advice and reassurance. It may be tempting to cash out and stay on the sidelines. But that’s almost ensuring losses, especially in today’s high-inflation environment. The chart below from Morningstar shows the impact of missing some of the best days in the S&P 500 over ten years ending December 31, 2021. So, if you feel that panic may be setting in, please call your Financial Advisor and discuss the current conditions and what it means for your portfolio.

What’s next?

Be on the lookout on July 28th for the Q2 2022 GDP growth (or decline) data that the Bureau of Economic Analysis will publish. Also, please read our article next month on how to position and prepare yourself (and your portfolio) during a recession.

Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

If you or anyone you know is worried about an upcoming recession, please visit our website for additional resources regarding financial planning and financial security. You can also click here or give us a call at 702-907-7444 to schedule a complimentary consultation, and speak with an experienced financial advisor.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Strategic Wealth Design and Cambridge are not affiliated.