A Review of the 3rd Quarter of 2021

Despite breaking multiple records, a rocky third quarter ended with a thud as concerns about inflation, political brawls, and viral variants weighed. 1

Let’s take a look at how markets performed and what we might look forward to in the months to come.

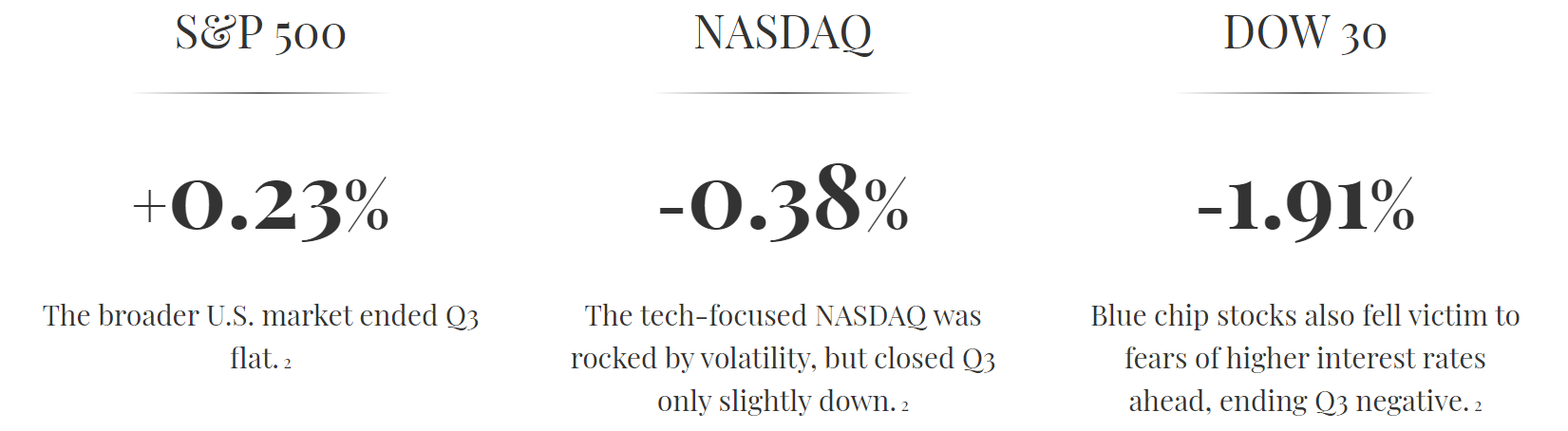

How Did Markets Perform Last Quarter?

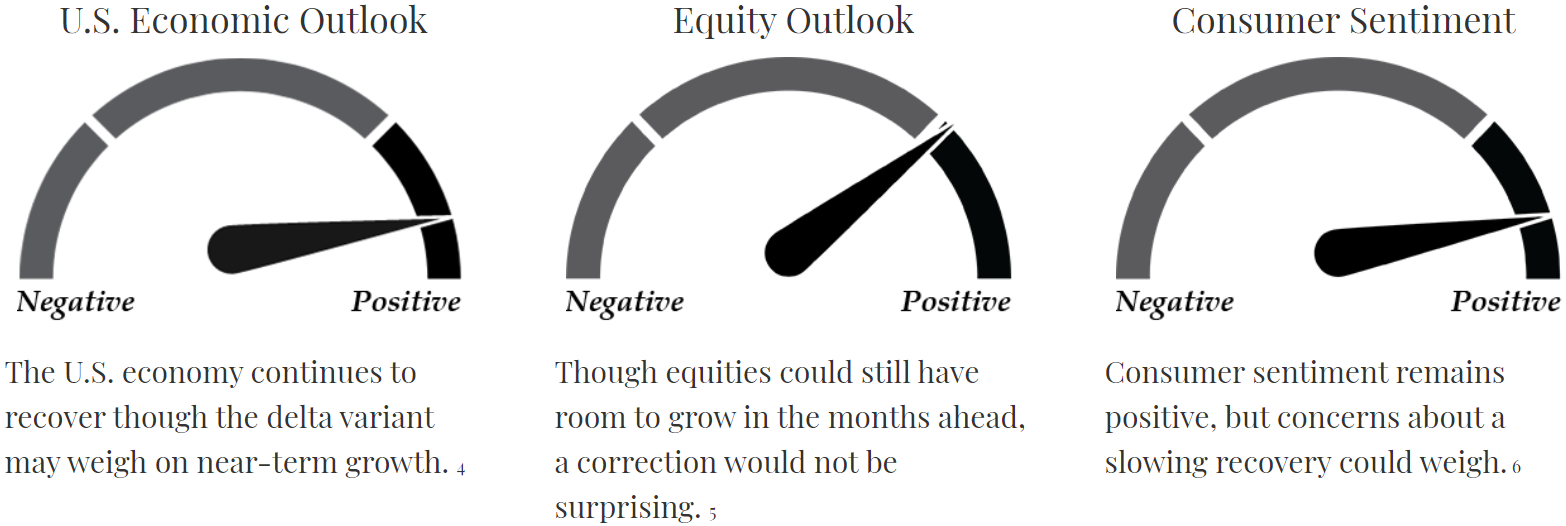

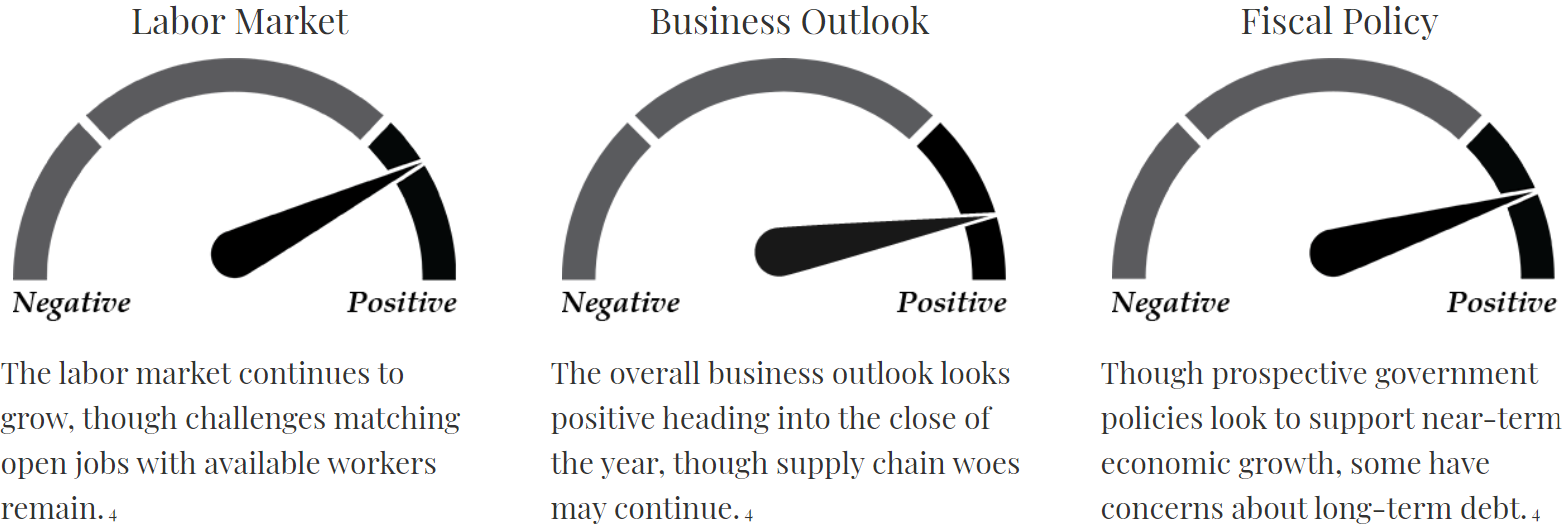

What Can We Expect in the Months Ahead?

Watch as the Directors of Investment Services in Independent Advisors Solutions by SEI review the global financial markets for the third quarter.

“As we head toward the finish line, we see some clouds on the horizon; however, we still hope for a solid end to the year.”

Key Takeaways for Savvy Investors

2021 opened with great optimism and hope that vaccines would put the pandemic in the rearview mirror.

The year so far had a lot of highlights: the U.S. economy roared back from its 2020 recession, personal incomes hit a high mark, home values increased, and U.S. companies enjoyed record profitability. 7,8,9,10

All that optimism has led to record-breaking stock performance (50+ all-time-highs in 2021), causing the S&P 500 to double in less than a year. 11,12

But, the clouds on the horizon could lead to more choppy seas. Maybe even a storm.

There are a few things I’m watching as we head toward the close of 2021:

- New COVID-19 variants

- Higher inflation

- Fed tapering

- Political and geopolitical concerns

- Economic growth

- The rising debt burden

Since markets are cyclical, the good times are bound to end, and now is a good time to be cautious.

The flipside is that rocky times don’t last forever either.

Bottom line, I’m keeping a close eye on conditions and staying flexible.

Questions about what’s going on? Please reach out. I’d be happy to chat.

Sources: 1 https://www.cnbc.com/2021/09/29/stock-market-futures-open-to-close-newshtml.html 2 https://www.nasdaq.com/articles/daily-markets%3A-q4-starting-off-rocky-as-interest-rate-fears-grow-2021-10-01 3 U.S. Economic Outlook, Equity Outlook, Consumer Sentiment, Labor Market, Business Outlook, and Fiscal Policy gauges: https://www.cnr.com/insights/speedometers.html (September 2021) 4 https://www2.deloitte.com/us/en/insights/economy/us-economic-forecast/united-states-outlook-analysis.html 5 https://www.blackrock.com/us/individual/insights/taking-stock-quarterly-outlook 6 https://www.conference-board.org/research/us-forecast 7 https://www.marketwatch.com/story/u-s-economy-grew-revised-6-7-in-second-quarter-gdp-shows-11633007236 8 https://www.nbcnews.com/business/business-news/personal-income-just-hit-record-high-here-s-where-spending-n1265948 9 https://www.usnews.com/news/economy/articles/2021-09-28/home-prices-continue-record-setting-pace-rising-197-in-july 10 https://www.reuters.com/business/investors-watch-us-companies-record-profit-margins-costs-rise-further-2021-09-22/ 11 https://www.marketwatch.com/story/sp-500-marks-51st-record-of-2021-matching-the-most-in-a-calendar-year-as-stocks-clamber-higher-wednesday-2021-08-25 12 https://www.yahoo.com/now/p-500-jumps-more-double-101210806.html S&P 500: https://finance.yahoo.com/quote/%5EGSPC/history?p=%5EGSPC (Closing price performance between June 30, 2021 and September 30, 2021) NASDAQ: https://finance.yahoo.com/quote/%5EIXIC?p=%5EIXIC (Closing price performance between June 30, 2021 and September 30, 2021) Dow Jones Industrial Average: https://finance.yahoo.com/quote/%5EDJI (Closing price performance between June 30, 2021 and September 30, 2021) The S&P 500 is a stock index considered to be representative of the U.S. stock market in general. The NASDAQ Composite Index is an unmanaged composite index of over 2,500 common equities listed on the NASDAQ stock exchange. The Dow Jones Industrial Average is a price-weighted index that tracks 30 large, publicly traded American companies. All index returns exclude reinvested dividends and interest. Indices are unmanaged and cannot be invested into directly. Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This content may contain projections, forecasts, and other forward-looking statements that do not reflect actual results and are based on hypotheses, assumptions, and historical financial information. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only. Advisory services offered through Cambridge Investment Research Advisors, Inc ., a Registered Investment Adviser. Strategic Wealth Design and Cambridge are not affiliated.