Why Is Financial Planning Important?

Americans, in general, are struggling with their finances. According to the NIRS (The National Institute on Retirement Security), 95% of millennials are not saving the recommended amount of money needed to secure their financial independence. That statistic is just one of the hundreds that have raised economic red flags. Certified Financial Planners (CFPs) and Financial Advisors are some of the nation’s most valued resources right now. Why?

-

- 69% of households have less than $1,000 in emergency savings.

- 66% of millennials have zero retirement savings.

- 34% of all Americans have $0 in their savings account, and over 65% have outstanding loans.

- 38% of households are balancing HUGE credit card debt.

And the most worrying statistic?

More than 72% of Americans do not have a Financial Plan in place. They have no set goals, no motivations, and are generally working on auto-pilot and guesswork.

What Is Financial Planning?

Financial Planning is an ongoing process for evaluating one’s finances and how it stacks up to their goals. Personal Financial Planning, in its most basic form, looks at where you are at today, where you want to be, and what is the most efficient way to get you to your goals. It’s important to understand the basic concepts of what the field does before going on Google and searching for “Financial Planner near me.”

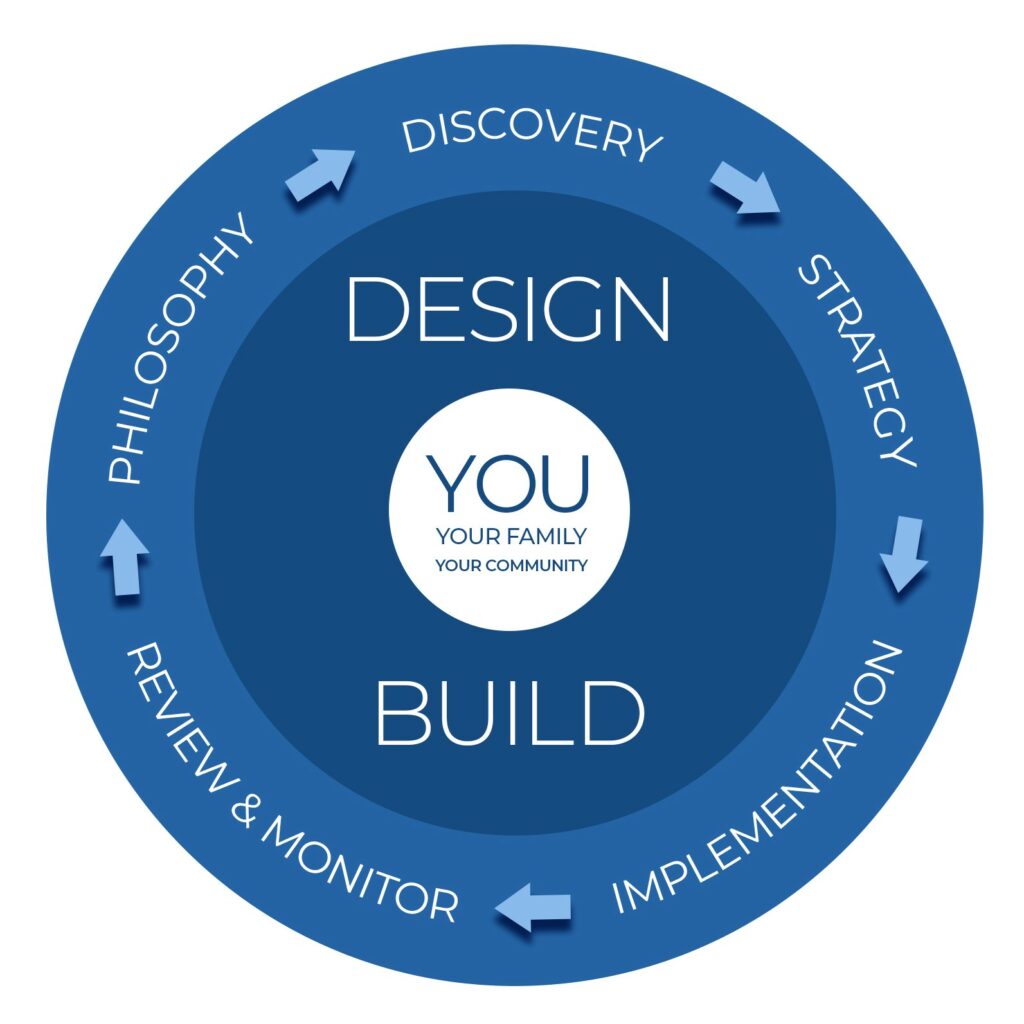

I always compare building a Financial Plan to building a house. To construct a house, you generally have a Design Phase and a Build Phase. Once the house is built, you’ll have to maintain and update it.

During the Design Phase, you work with an architect to lay out an efficient plan to maximize the space. Similarly, in Financial Planning’s Design Phase, you look at your current financial resources and your future goals and come up with an efficient plan to maximize your financial resources to achieve those goals.

During the Build Phase, you work with a General Contractor that can help build that dream home. This is where the rubber meets the road, and you can start seeing your home come together. Similarly, in Financial Planning’s Build Phase, you work with an Advisor or Planner to help implement the recommendations that came from the Design Phase. This is the most critical step, as a Financial Plan without commitment to take action is a waste of time and money.

Once the house is built, it will need maintenance and updating to keep it in tip-top shape. Similarly, once your Financial Plan has been implemented, you’ll need to ensure it is maintained and kept up to date to keep in step with your goals and life stages.

Here are some reasons why you may need Financial Planning:

-

- To make sure you don’t outlive your money in retirement.

- To have a game plan to get out of debt.

- To look at ways to lower your taxable income.

- To evaluate if you have the appropriate amount saved in case of an emergency.

- To prepare for the birth or adoption of a child.

- To prepare to pay for a child’s college education.

- To evaluate your insurance and if you have appropriate amounts of coverage.

- To review your investments and maximize your returns.

As you can see, Financial Planning addresses a variety of topics, and a comprehensive plan will help you address multiple concerns at the same time. If properly executed and managed, a Financial Plan allocates ALL your resources in appropriate buckets to help you accomplish your hopes, dreams, and goals.

Understanding the Financial Planning Process

How does Financial Planning work? There are five critical steps in the Financial Planning process to ensure your plan is comprehensive and always in tune with your current goals.

Discovery

In the Discovery stage, a Financial Planner will not only need all your financial data but will ask you:

“What do you want to accomplish, financially speaking?”

A good Financial Planner will take time in the Discovery stage to get to know you better and learn about your hopes, dreams, and concerns. He/she will review all your financial data and all the good, bad, or ugly money decisions you may have made in the past. You’ll have to come face to face with your finances and whether or not your goals are SMART (specific, measurable, achievable, relevant, and time-bound). This stage is your opportunity to build trust and a long-lasting relationship with your Financial Planner as he/she will most likely be your most trusted advisor.

Analyzing the Data

Once the data has been gathered, you and your Financial Planner can develop a financial picture of who you are right now, economically speaking. During this step, your Financial Planner will:

-

- Calculate your net worth. This figure comes from taking all of your assets – like your bank accounts, real estate, cars, investments, retirement plans, and anything else you might own that is of value, and subtracting your liabilities – credit card debts, loans, outstanding tax payments, etc.

- Determine your cash flow. There is an in-depth analysis of your spending habits – understanding what comes in (revenue) and what goes out (expense).

- Evaluate your risks. Your insurance policies are reviewed to make sure they adequately protect your assets, your income, and your family.

- Evaluate current investments. This involves reviewing your current investment strategy and seeing if it is in line with the amount of risk you are comfortable taking.

Creating a Strategy

Once your Financial Planner has your objectives and your financial data in place, they can strategize how to make the two come together in the most efficient manner.

A thorough Financial Planner will not only take into account your objectives but will also look at a variety of “what-if” scenarios. Some of these scenarios can be provided by you, while others may be ones you hadn’t even thought of. A few examples of strategizing questions are:

-

- What if taxes increase in the future?

- What if there was a premature death of a breadwinner?

- What if markets dropped before and/or during retirement?

- What if we run out of money during retirement?

- Are we saving enough for retirement?

- Will we be able to afford college expenses?

The answers to these questions, along with your goals and dreams, will help determine your financial strategy. Together, you and your advisor can develop a plan that is best suited to your individual needs and goals.

Implementing the Plan

Putting the plan to work might not be as simple as it sounds. It is one of the most challenging phases in Financial Planning. Plans take discipline, sacrifice, and the desire to implement. Just know your Financial Planner is your support system and is there to answer any questions or concerns you may have during the process.

He/she will establish who will implement the various recommendations and the timeline involved. In this stage, procrastination can delay your ability to hit your goals in your established time frame. Your Financial Planner will act as your coach and hold you accountable to help ensure you are on track to achieve your goals.

Monitoring, Reviewing, and Updating

Financial Planning is an ongoing process. The process doesn’t end once you first establish your plan. This is because your plan isn’t static; it’s meant to grow with you and all your life changes. As your goals and priorities shift, so does your plan. It also adjusts for outside influences like stock market fluctuations, new tax laws, and inflation. All of this is done through the monitoring of your plan by your Financial Planner. This is why it’s crucial you find a Financial Planner you trust and who understands your goals, as the relationship you have with them is significant and life-long.

As you can see, going through the Financial Planning process with a Certified Financial Planner is key to getting your finances in order and your money working best for you. If you’re interested in talking to a professional advisor, we offer free initial consultations. You can schedule your consultation here. There’s no better time than now to start the journey towards achieving your financial goals.