A Review of the 4th Quarter of 2021

Markets delivered exceptional performance in a year that had a little bit of everything: politics, bubbles, meme stocks, inflation, runaway rallies, and sudden drops.

Let’s take a look at how markets performed last year and what we might look forward to in the first months of 2022.

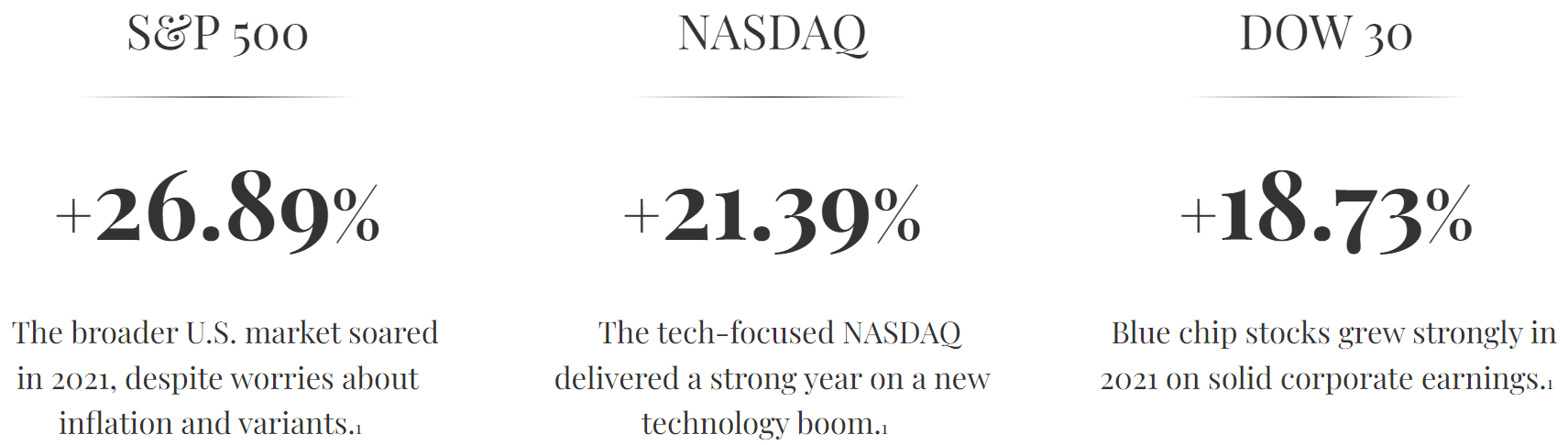

How Did Markets Perform Last Quarter?

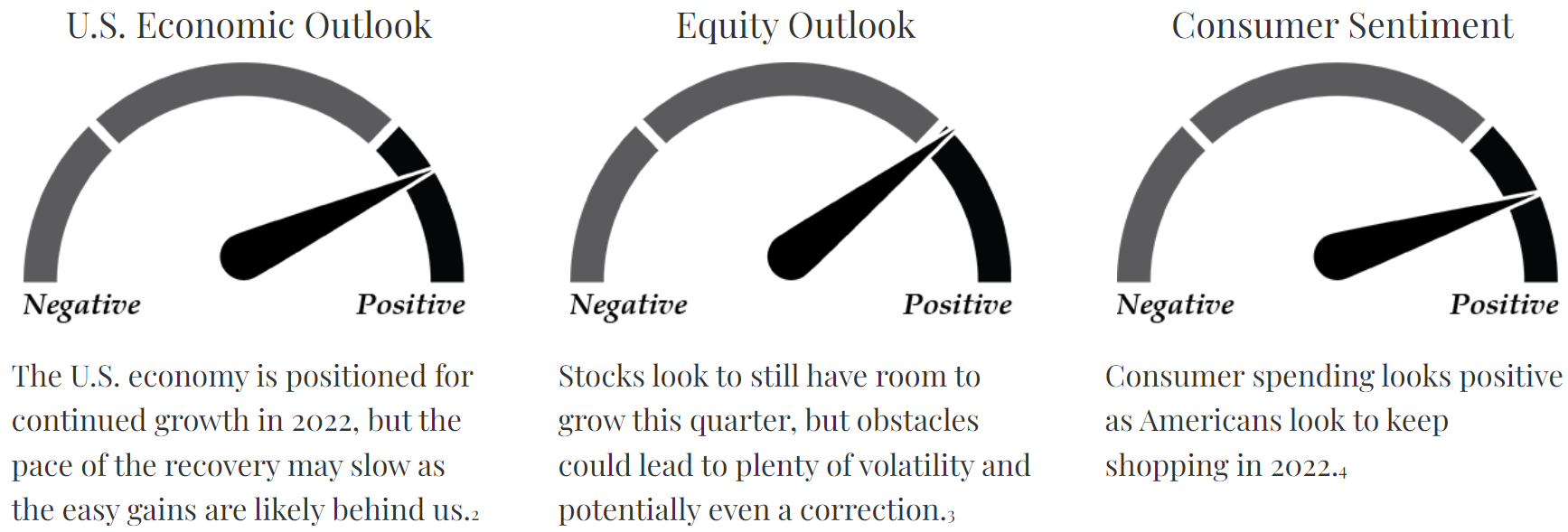

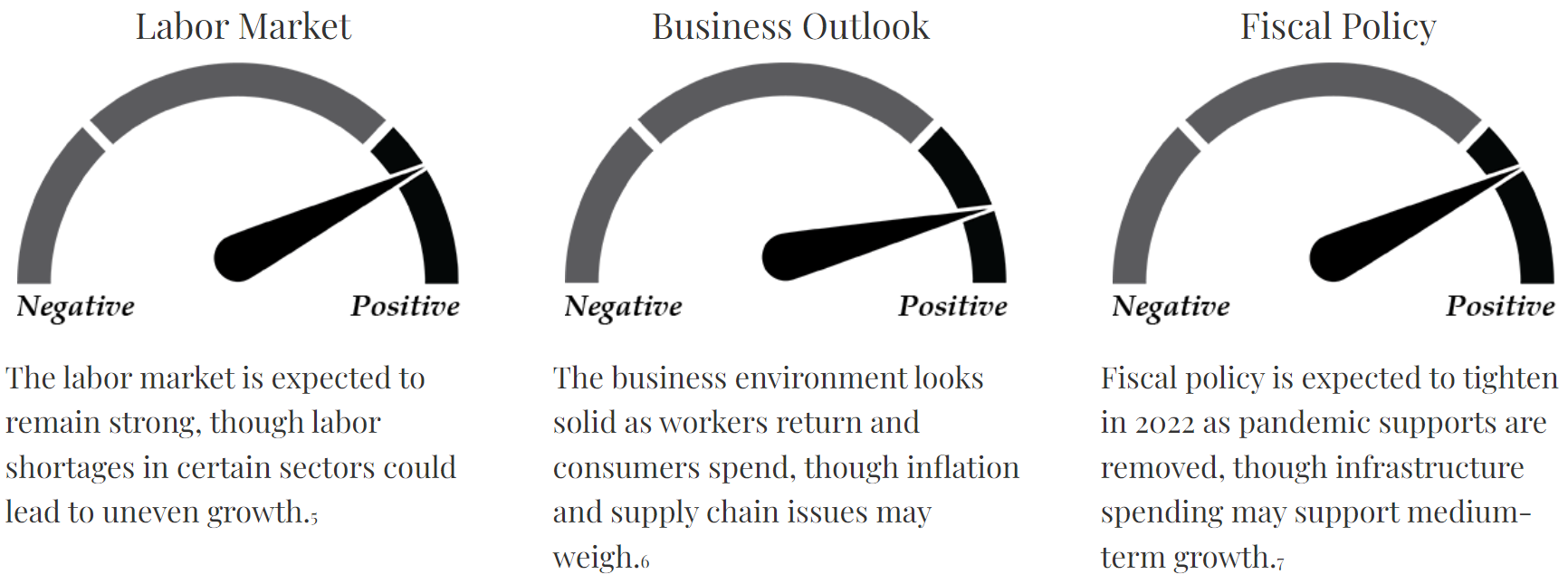

What Can We Expect in the Months Ahead?

“While pandemic disruptions remain, 2022 offers hopes of greater normalcy.”

Key Takeaways for Savvy Investors

Despite another year of uncertainty around COVID-19 variants, vaccines, and the economy, markets delivered an extraordinary performance in 2021. Looking back, while it’s easy to cheer a strong year, let’s not forget that there were many dips, pullbacks, and anxious moments along the way.

That’s just part of the journey.

What can we look forward to in 2022?

Signs point to continued growth amid hope that variants will become less dangerous as treatments advance and humans (and our institutions) adapt.

However, much of the “easy” recovery from the pandemic bottom is behind us and inflation, supply chain snarls, and labor market shortages remain thorny issues.

Given the market highs we’ve seen recently, volatility and pullbacks are very likely.

Overall, I’m cautiously optimistic about this quarter’s trajectory. However, I’m also keeping a close eye on market conditions, as continued uncertainty could drive sudden changes.

Questions? Please reach out. I’d be happy to chat.

Sources:

1 https://www.cnbc.com/2021/12/30/stock-market-futures-open-to-close-news.html 2 https://www.cnn.com/2021/12/31/economy/economy-covid-inflation-2022/index.html 3 https://markets.businessinsider.com/news/stocks/stock-market-outlook-5-catalysts-keep-bull-market-thriving-2022-2022-1 4 https://www.marketplace.org/2021/12/31/what-might-consumer-spending-look-like-in-2022/ 5 https://www.cnn.com/2021/12/03/perspectives/jobs-labor-market-trends-2022/index.html 6 https://www.cnbc.com/2021/12/16/why-former-us-treasurer-is-optimistic-about-economy-in-2022.html 7 https://www.fitchratings.com/research/sovereigns/north-america-to-grow-strongly-in-2022-policy-will-tighten-14-12-2021 U.S. Economic Outlook, Equity Outlook, Consumer Spending, Labor Market, Business Outlook, and Fiscal Policy gauges: https://www.cnr.com/insights/speedometers.html (December 2021). The S&P 500 is a stock index considered to be representative of the U.S. stock market in general. The NASDAQ Composite Index is an unmanaged composite index of over 2,500 common equities listed on the NASDAQ stock exchange. The Dow Jones Industrial Average is a price-weighted index that tracks 30 large, publicly traded American companies. All index returns exclude reinvested dividends and interest. Indices are unmanaged and cannot be invested into directly. Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This content may contain projections, forecasts, and other forward-looking statements that do not reflect actual results and are based on hypotheses, assumptions, and historical financial information. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only. Advisory services offered through Cambridge Investment Research Advisors, Inc ., a Registered Investment Adviser. Strategic Wealth Design and Cambridge are not affiliated.